Today's cut means hundreds in savings for the average mortgage-holder.

The Reserve Bank of Australia (RBA) has delivered relief to thousands of mortgage-paying households, choosing to cut interest rates by 25 basis points.

Australia's official cash rate target will fall from 4.1 per cent to 3.85 per cent, a level it has not been at since May 2023.

For the average owner-occupier loan of $660,000, today's rate cut equates to $213 in monthly savings or an annual saving of more than $2500.

AS IT HAPPENED: Reaction as RBA slashes rates for the second time in 2025

In its monetary policy statement, the RBA board said economic conditions were right to reduce the cash rate today, but the outlook ahead was still uncertain.

"With inflation expected to remain around target, the Board therefore judged that an easing in monetary policy at this meeting was appropriate," the statement said.

"The Board assesses that this move will make monetary policy somewhat less restrictive.

"It nevertheless remains cautious about the outlook, particularly given the heightened level of uncertainty about both aggregate demand and supply."

While the bank's first cut of the year in February was described as a "hawkish" one, with the RBA still concerned about the possibility for a surge in inflation, Governor Michele Bullock struck a more confident tone following today's decision.

"We have got a little more comfortable, just a little more comfortable, that things are going in the right direction," she said.

"So we can take a break just a little bit more."

She said the board also discussed the possibility of a 50-basis-point cut, before deciding the case for the 25-basis-point reduction was stronger in what was a consensus decision.

Graham Cooke, head of consumer research at Finder, said there was still a possibility that 2025 held two further rate cuts for households sweating on payment relief.

"Frankly, two cuts might not be enough to ease the spike in mortgage stress we've seen since the cash rate started rising again in May 2022," he said.

"But it's a step in the right direction and it's great news for homeowners. It's two down and maybe two more to go this year.

"On an average home loan, if your bank passes on both rate cuts in full, you could be saving almost $2600 per year."

READ MORE: 'Profound sadness:' Cruise ship captain dies on board after medical emergency

Today's rate cut will likely fuel a rash of interest in auctions, with property data firm Cotality finding that many vendors were waiting for the central bank before listing their property.

"It seems that many vendors are holding out for the RBA's interest rate decision this week," Cotality Research Analyst Caitlin Fono said.

"The volume of scheduled auctions across the combined capitals is set to rise to around 2360 this week – a 29 per cent jump on last week, before rising further next week, to around 2700 auctions."

Sally Tindall, Canstar data insights director, said the downside of today's rate cut will come to those looking to enter the market by saving up a deposit.

READ MORE: Nationals split from Liberal Party after failing to reach agreement

"Cash rate cuts are a double-edged sword because while one-third of households have a mortgage, two-thirds of households have money in the bank as savings or are, at the very least, aiming to," Tindall said.

"In the past month, we've seen dozens of banks cut term deposit rates as the banks price in the possibility of a rate cut.

"We've also seen some banks come through quietly and cut some of their key savings rates twice – that is, after the February RBA cut, but then again out of cycle.

"While term deposit rates above 5 per cent have now been relegated to the history books, at least for now, savers can still find rates above 5 per cent if they're willing to jump through a few hoops each month to qualify."

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.

Too late to leave as floodwaters rise in Hunter region

Too late to leave as floodwaters rise in Hunter region

'Skipping meals, eating food from bins': Cost of living crisis laid bare

'Skipping meals, eating food from bins': Cost of living crisis laid bare

'Double-edged sword': What interest rate cut may mean for house prices

'Double-edged sword': What interest rate cut may mean for house prices

Supermarket boss launches explosive defence of staff member targeted by racial abuse

Supermarket boss launches explosive defence of staff member targeted by racial abuse

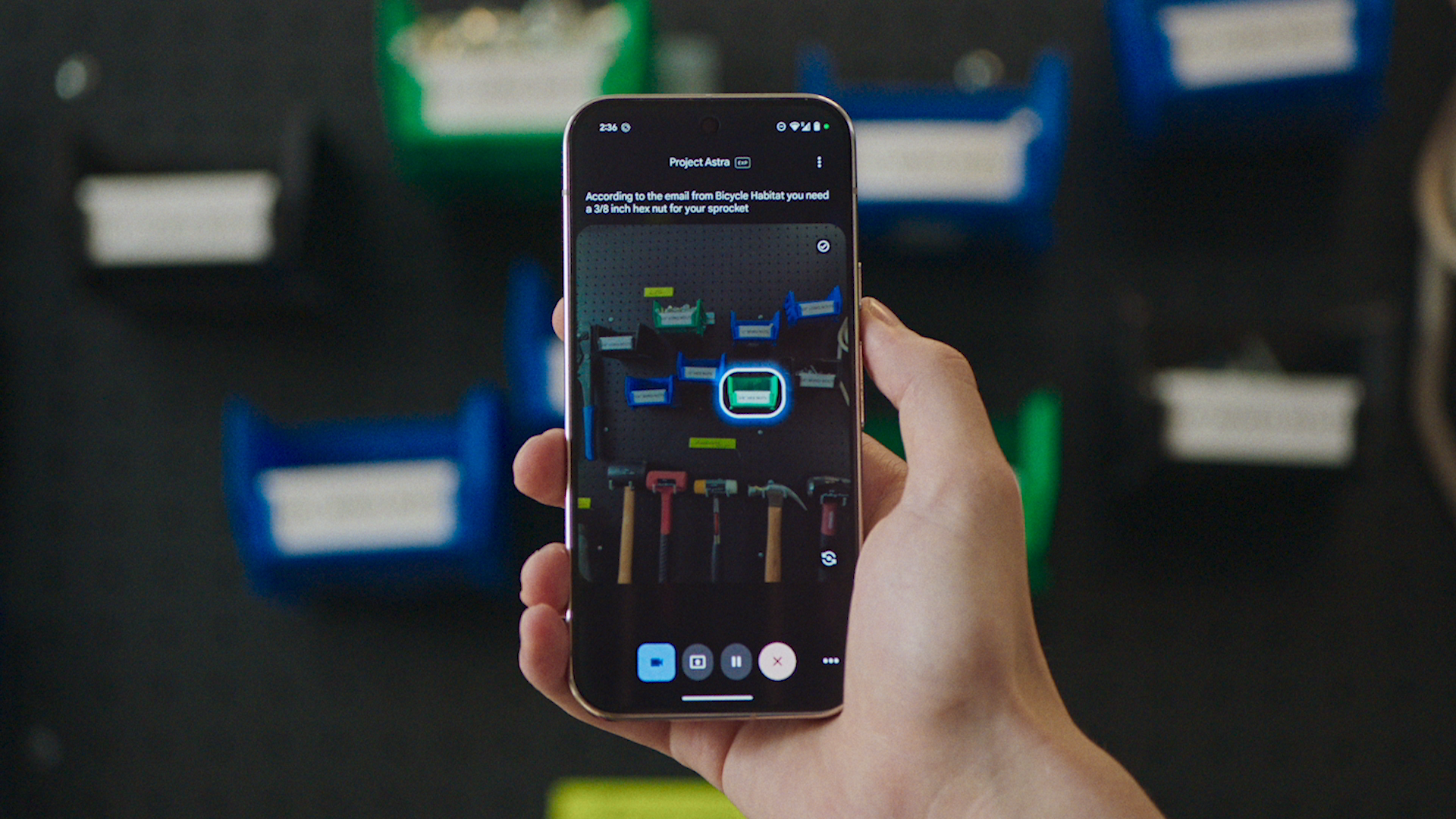

Google unveils new AI search, personal assistant and automated shopping experiences

Google unveils new AI search, personal assistant and automated shopping experiences

'Horrified' UK suspends free trade talks with Israel over Gaza

'Horrified' UK suspends free trade talks with Israel over Gaza

Triple Olympian Lisa Curry's mission five years after daughter's death

Triple Olympian Lisa Curry's mission five years after daughter's death

George Wendt, actor who played Norm on 'Cheers,' dead at 76

George Wendt, actor who played Norm on 'Cheers,' dead at 76

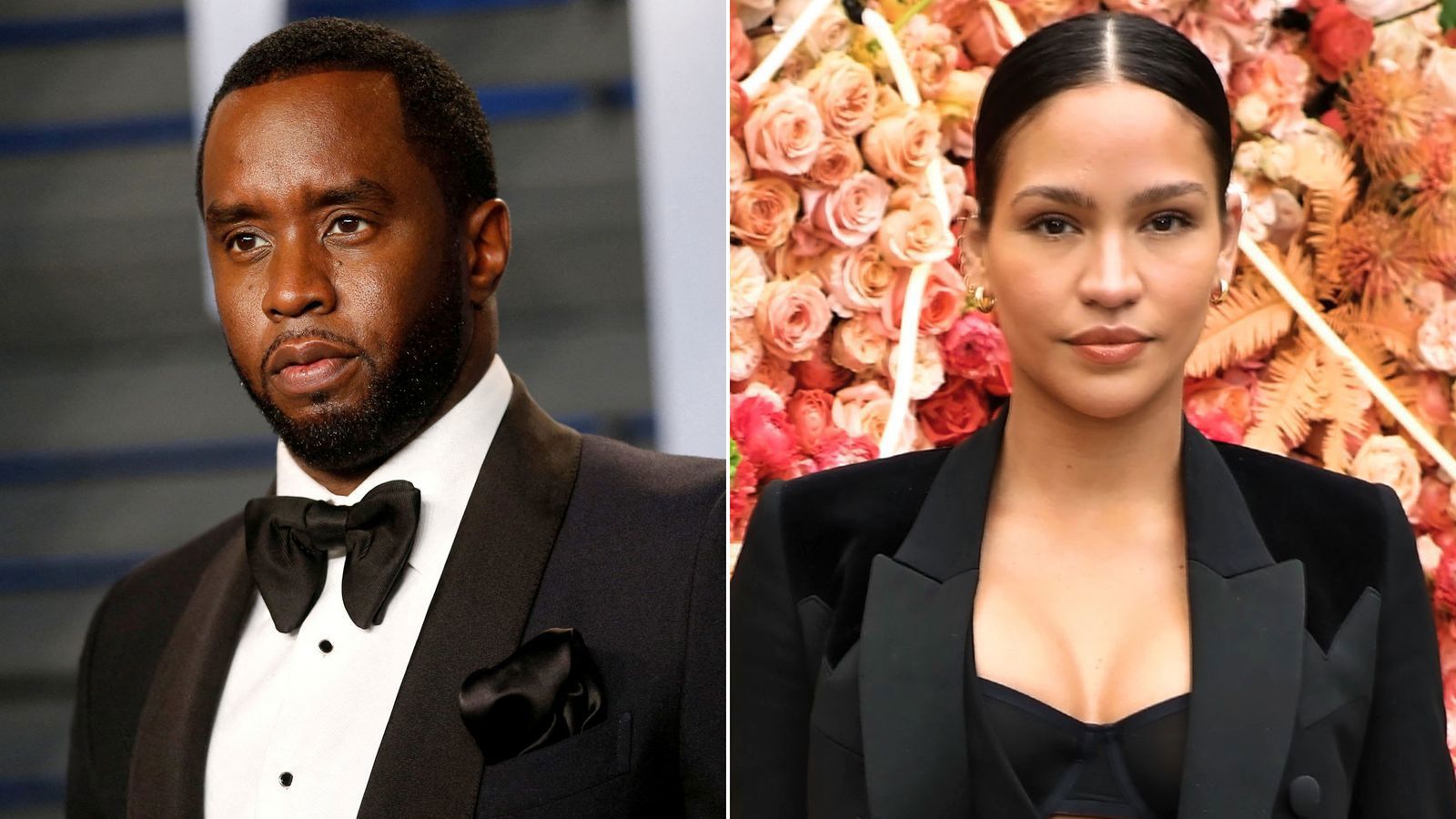

Cassie's mother says Sean 'Diddy' Combs demanded more than $30K

Cassie's mother says Sean 'Diddy' Combs demanded more than $30K

In pictures: Rising floods cut off towns, rescues underway

In pictures: Rising floods cut off towns, rescues underway

'Stupid move': Howard slams decision to blow up Coalition partnership

'Stupid move': Howard slams decision to blow up Coalition partnership

Ute driver captured on camera causing crash before driving into second car

Ute driver captured on camera causing crash before driving into second car

Queensland police officers filmed losing cool at driver

Queensland police officers filmed losing cool at driver

Qantas' apology for illegal sackings slammed as 'hollow'

Qantas' apology for illegal sackings slammed as 'hollow'

'Profound sadness:' Cruise ship captain dies on board after medical emergency

'Profound sadness:' Cruise ship captain dies on board after medical emergency

Aussie billionaire to give away half of fortune

Aussie billionaire to give away half of fortune

These surreal trees survived for centuries. Scientists worry for their future

These surreal trees survived for centuries. Scientists worry for their future

This 2000-piece woodpile hid one of the world's deadliest snakes

This 2000-piece woodpile hid one of the world's deadliest snakes