What do you get if you combine an interest rate cut – and the possibility for several more – with a crisis-level housing shortage?

What do you get if you combine an interest rate cut – and the possibility for several more – with a crisis-level housing shortage?

Common sense would suggest the answer is obvious: a big spike in property prices.

But while they're expected to rise following the Reserve Bank's decision to reduce the cash rate to 3.85 per cent on Tuesday, a repeat of the stratospheric surges from a few years ago seems unlikely.

READ MORE: Millions of home owners holding out for more interest rate cuts: survey

"The upshot is that we would expect property prices to continue rising over 2025 but it is possible that they won't rise as strongly as they did in 2024," Cotality head of research Eliza Owen told 9news.com.au.

Interest rates aren't the be-all and end-all for prices, particularly when you look away from Sydney and Melbourne.

"The reduction in interest rates historically has had the biggest impact on higher-end property markets on the east coast," Owen said.

"There's less of a correlation with property markets in Western Australia, Adelaide and parts of Queensland, potentially because they're more tied to things like commodities performance, for example, in WA.

"And so what we saw during interest rate rises is that Perth, Adelaide and Brisbane actually had really strong performance.

"There's no guarantee that they'll get back to that double-digit growth just because interest rates are falling now."

Nationally, property prices rose 5 per cent last year.

Owen says something "around that or a little bit less" is on the cards this time around, while AMP forecasted last week that there would be a 3 per cent rise for the year.

A more moderate increase will no doubt come as welcome news to Australians hoping to finally buy their first home in the near future, but it shouldn't be mistaken for a sign the nation's housing market is getting to a point where it's no longer considered a crisis.

Just a day after the RBA cut rates, the National Housing Supply and Affordability Council released its annual report on the state of the housing system.

It's bleak reading.

While there were some silver linings – affordability is expected to stabilise and potentially even improve over the next four years, and social and affordable housing stock is increasing – the level of overall supply, the main culprit for rising unaffordability for buyers and renters, is in a poor state.

READ MORE: Why are there so many banknotes, when hardly any of us are using cash?

"The supply of new housing is near its lowest level in a decade," the report states.

"177,000 dwellings were completed in 2024, falling significantly short of underlying demand for housing, which was estimated at around 223,000 for the same period.

"This shortfall added to already significant unmet demand in the system."

The report also found that not only is Australia set to undershoot the federal government's mid-2029 goal of building 1.2 million new homes by some 262,000 dwellings, we're also on track to fail to meet underlying demand for new homes by 79,000.

Markets are expecting several more rate cuts by early next year, and the federal government's housing policy allowing buyers to purchase their first home with a 5 per cent deposit, which experts say will do little but push prices up further, starts in January.

READ MORE: Aussie billionaire to give away half of fortune

On top of low supply, that seems like the perfect storm for another price boom. So why aren't double-digit increases on the cards once again?

Owen says soft economic outlooks, global uncertainty and normalising migration levels will all help keep a lid on prices.

And ultimately, after years – and, indeed, decades – of surging costs, there's only so much Australians can afford to spend on housing.

"At the end of the day, you can only really have this ever-increasing demand if people can afford to get into the market," Owen says.

"And I think there is a scenario where the rate cuts provide a bit of a sugar hit for market values, but they'll ultimately be weighed down longer-term by affordability constraints and the potentially softer economic outlook.

"It's a mix of headwinds and tailwinds, and obviously it's difficult to know where all of those factors are going to land... but we would expect off the back of this mix of factors that home values would continue to rise."

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.

Premier's extraordinary ban after shopping centre brawl

Premier's extraordinary ban after shopping centre brawl

Bodies of five skiers found on Swiss glacier

Bodies of five skiers found on Swiss glacier

Aldi outdoor heater recalled over potential risk of serious injury

Aldi outdoor heater recalled over potential risk of serious injury

'Hell on earth': Overwhelming Aussie support for more help in Gaza

'Hell on earth': Overwhelming Aussie support for more help in Gaza

Two charged after shopping centre knife fight

Two charged after shopping centre knife fight

Man fighting for life after two shot in western Sydney drive-by shooting

Man fighting for life after two shot in western Sydney drive-by shooting

Coalition reunion seems inevitable but tensions remain

Coalition reunion seems inevitable but tensions remain

Locals return to clean out homes, shops all but swallowed by floods

Locals return to clean out homes, shops all but swallowed by floods

One phone call landed Nikola with a $36k debt. She didn't find out for years

One phone call landed Nikola with a $36k debt. She didn't find out for years

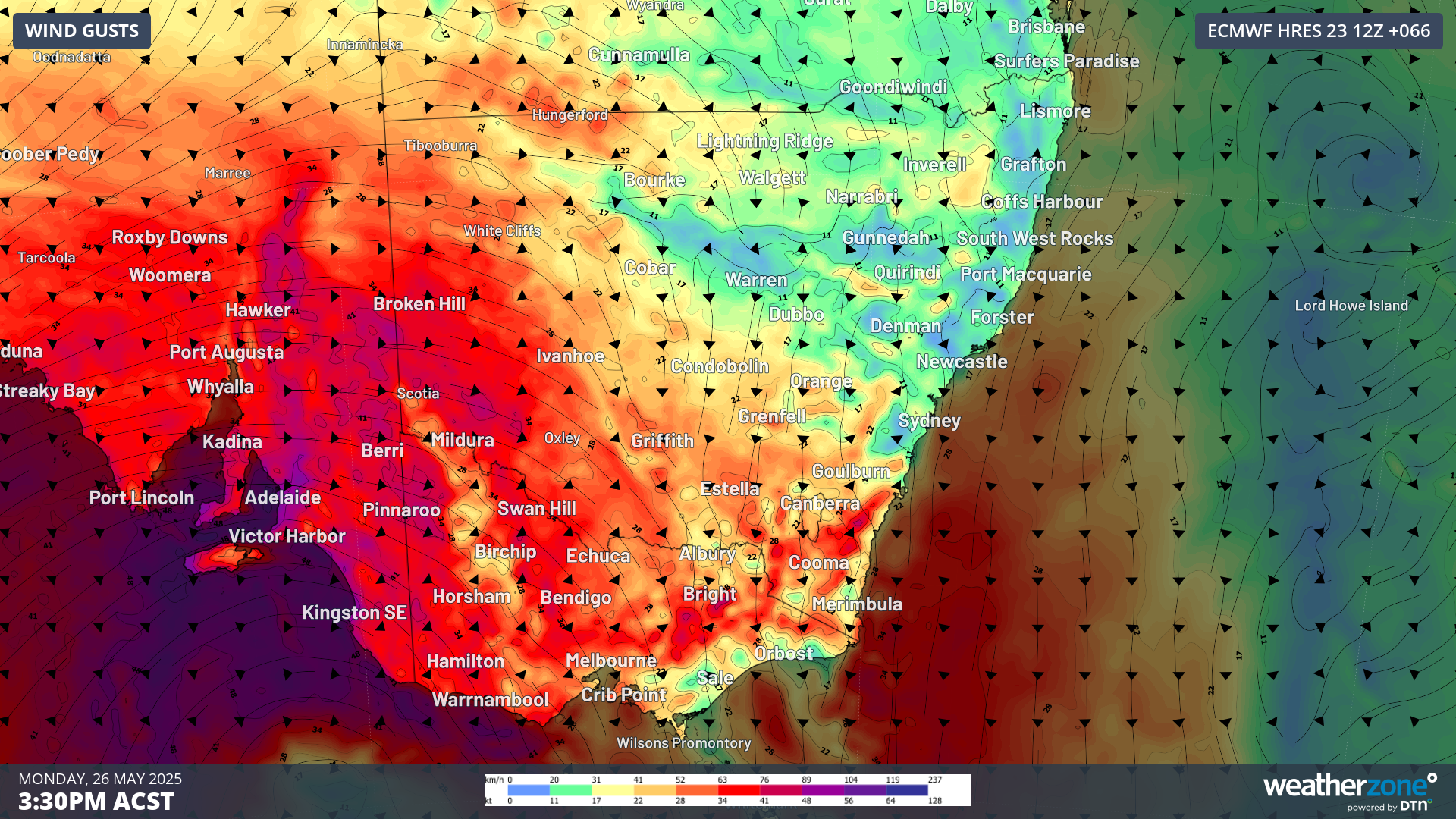

Most powerful cold front of the year to smash states with 125km/h winds

Most powerful cold front of the year to smash states with 125km/h winds

Oscar's mum says his life was saved by a service many don't know exists

Oscar's mum says his life was saved by a service many don't know exists

Family's search for answers after missing dad found dead in field

Family's search for answers after missing dad found dead in field

Nine of a doctor's 10 children killed in Gaza strike

Nine of a doctor's 10 children killed in Gaza strike

Everything we know about the suspicious disappearance of Pheobe Bishop

Everything we know about the suspicious disappearance of Pheobe Bishop

Three arrested as dictator rages over disastrous warship launch

Three arrested as dictator rages over disastrous warship launch

'There's never been a drought like this': Farmers plead for help in South Australia

'There's never been a drought like this': Farmers plead for help in South Australia

Victorian dad labelled 'an Aussie hero' for thwarting attempted robbery

Victorian dad labelled 'an Aussie hero' for thwarting attempted robbery